From Unmanned Systems Magazine: ISIS, CHINa, rUSSIa FUeL NeW GrOWTH IN UaS SeNSOrS aNd TeCHNOLOGIeS

In this first of two articles, we will look at the 10-year future for the military unmanned aircraft sensor market, focusing on U.S. systems and programs, including international markets for U.S. systems.

UAS have primarily served as sensor trucks, and will largely continue to do so despite the growth of armed drones. Although Teal Group Corp. sees combat UAVs (UCAVs) as a major growth area, these and other UAS will continue to serve as vehicles for bringing ISR and other sensors to bear on an area or target — targeting sensors will just be more sophisticated and expensive.

Drones and drone sensor development and funding increased rapidly in the decade after the attacks of 9/11, with some growth continuing in recent years. But the financial crisis of 2008, proposed budget cuts, and the possibility of sequestration resulted in several years of up-and-down funding in military markets, and considerable uncertainty. Electro- optical/infrared (EO/IR) sensors — often gimbaled “sensor balls” — have been the default sensor for the vast majority of UAS, and Teal Group historical data show a $779 million UAS EO/IR market in fiscal year 2009 and $781 million in FY ‘13.

But we saw this end of growth as only a pause, as most major U.S. endurance UAS platform programs were ending or nearing the end of their planned production runs. Since 2015, budgets have extended future production for several MALE and HALE programs, such as the USAF Reaper and U.S. Army Gray Eagle. And this year the USAF is receiving three additional Block 30 Global Hawks. Global Hawk international sales have also begun with urgent orders from South Korea and Japan, and Germany and Australia (Triton).

What’s more, a comprehensive new generation of EO/IR sensors is now scheduled and paid for in U.S. defense budgets. Along with the unexpected resurgence of the high altitude long endurance (HALE) EO/IR market sector, comprehensive “next-generation” sensor ball retrofits are beginning for hundreds of Reapers and Gray Eagles. Though unheralded in the media (“upgrades” rarely grab headlines), the bulk of the U.S. endurance UAS fleet will receive all-new sensors in the next few years, worth billions of dollars to both prime contractors and subs.

The lull in UAS EO/IR sensor market growth is proving to have been temporary, as forecast. The need for ISR has increased, as the draw-down of troops from major ground wars in Central Asia has been followed by the need for more ISR for even broader wars such as the conflict with ISIS. The shift in geopolitics to China and Asia will raise new requirements for longer- range maritime and overland UAS ISR that is either stealthy or protected in an A2/AD (Anti-Access/Area Denial) environment, or both.

And new near-peer conflicts like the continuing war in eastern Ukraine — and Russian nuclear saber-rattling — show how beneficial it would be to already have a fleet of “invisible” high-speed, high-altitude stealthy ISR (Intelligence, Surveillance and Reconnaissance) UAS to monitor the border and beyond, which is why classified programs such as the U.S. Air Force RQ-180 were needed yesterday and will receive major funding today and tomorrow. Note, for example, recent claims that an EQ-4 “BACN” Global Hawk was shot down by a Russian S-300 SAM over the Mediterranean near Syria in June 2017. Global Hawks would be defenseless in a near-peer conflict, requiring urgent acquisition of even more expensive and sophisticated UAS and long-range sensors.

Our forecasts

Legacy drone systems will remain in service, in demand, and funded for sensor upgrades, while new UAS and new UAS sensors — from expensive, stealthy A2/ AD-capable systems to much more capable and expensive sensors for thousands of small tactical/mini/nano- UAS — will result in steady EO/IR market growth, starting now. And when retirements do occur — the USAF decided in 2015 that it would mothball its entire Predator fleet in 2018 — they will often be accompanied by funding for major sensor upgrades to the remaining fleet, such as the likelihood of a $1 billion comprehensive sensor ball retrofit for more than 300 USAF Reapers that will continue in service.

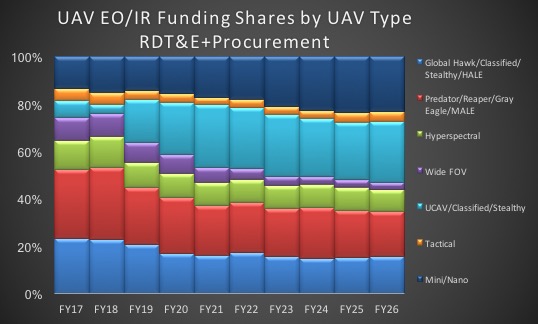

UCAVs and mini/nano-UAS will be the fastest-growing market segments as small UAS EO/IR sensors become nearly equivalent to (and as expensive as) today’s endurance UAS sensors, and larger UCAV systems become manned- aircraft equivalents — with Joint Strike Fighter capability and expense — leading to substantial overall increases in our speculative out-years forecasts.

Teal Group forecasts steady growth in the UAS EO/IR market, rising from $1.1 billion in FY ‘17 to $1.7 billion in FY ‘21, and almost doubling to $2 billion in FY ‘26. Note that FY ‘16 included the first chunk of large continuing funding for transferring manned U-2 ISR aircraft sensors to Global Hawk, as well as the first production sensors for the new South Korean and USAF Global Hawks.

The current generation of legacy UAS programs will also be supplemented by more and more classified future programs in all mission areas — not just the USAF RQ-170 and (possible) RQ-180 — leading to an increasing percentage of future funding hidden in the Pentagon’s massive classified budget. It is vitally important to forecast these programs, even speculatively, as they make up more and more of the market available to developers and manufacturers.

Finally, Teal Group’s outlook includes speculative forecasts of “undetermined, uncontracted” sensor programs for both the near-term and the out-years, covering the most likely (or, sometimes, absolutely necessary) programs and production that may not yet be in the budgets or under public discussion, or announced by international customers.

An RQ-1 Predator flies with a Raytheon Multi-Spectral Targeting System and SeaVue sensors. Photo: General Atomics Aeronautical Systems.

Speculative new starts

With hundreds of Predators, Reapers, and Gray Eagles in service today, combined with no-longer ended-for-good Block 30 Global Hawk production and the beginnings of Navy Triton production, traditional HALE and MALE (medium altitude long endurance) UAS electro- optics spending — the backbone of the past decade’s market — will surprisingly hold its own or even grow slowly over the next decade. Added to new programs such as the Air Force’s recently revealed (but now dark again) RQ-180 stealth ISR UAS, HALE and MALE sensor EO/IR markets should remain the largest market segments through at least the end of this decade.

Teal Group also anticipates new sensors or sensor modifications for a partial shift of continuing EO/IR funding toward long-endurance maritime patrol and

over-sea mission sensors with the United States’ strategic “pivot to Asia.” Synthetic aperture radars (SARs), to be discussed in a following article, already routinely include maritime modes in current upgrades.

New technologies

There will be many new technologies for both endurance and smaller UAS, including wide field-of-view (WFOV) EO/IR and hyperspectral sensors. But hyperspectral systems have yet to see a major breakout unclassified production program in 20 years of development, and WFOV EO/IR may be increasingly supplanted by new, smaller SARs that can operate through weather.

Teal Group speculatively forecasts relatively stable WFOV EO/IR funding from FY17 to FY26, with slowly increasing hyperspectral funding.

The greatest growth in our 10-year UAS EO/IR forecast will be for UCAVs and small UAS, admittedly from low levels today and with few program of record funding lines in unclassified Department of Defense documents. We see development and production of increasingly sophisticated sensors for smaller tactical and mini/nano-UAS, with a continuing “trickle down” of large-UAS sensor capabilities to small UAS. We forecast Combat UCAVs as the other strong growth market, though these UAS will be large tactical or endurance systems. Both of these markets again rely on speculative new programs to avoid a flat or decreasing market following the end of massive small-UAS purchases

for wars in Asia over the past decade, and public cancellation of several major planned stealth UAS programs — the USAF UCAV and MQ-X, and most recently the Navy UCAS-D/UCLASS.

UCAVs will require manned aircraft-equivalent sensors (or more accurately, man-replacement) and extreme high-end capability, while mini/nano-UAS will focus on extreme miniaturization and a fair amount of basic scientific/materials research.

Teal Group forecasts numbers of mini/ nano-UAS sensors procured by next decade will be in the thousands annually — similar to numbers a few years ago for Asian wars. Several years ago, the Air Force Research Laboratory expected tiny drones the size of a sparrow could fly by about 2015, but this size UAS was already in military service with the United Kingdom by 2012 — and in the service of 19 NATO- allied militaries (though not yet the U.S.) by 2016. The Air Force has declared it wants to have swarms of UAS no larger than dragonflies by 2030; we suspect this date will also move forward.

To give support to our large forecast numbers, more than 40,000 FLIR Systems Photon 320 uncooled IR cameras were reportedly produced for small UAS over the past decade or so. The U.S. Army procured more than 15,000 RQ-11 Raven Mini-UAS.

But now that mini/nano-sensors have become much more sophisticated — gimbaled, multi-spectral EO/IR sensors — unit costs have shot up almost to tactical UAS sensor levels. AeroVironment’s much higher-capability, gimbaled Mantis i23 EO/ IR Sensor for the Raven originally cost between $30,000 and $48,000, budgeted at $66,000 per UAS by the U.S. Army. Our production forecast is for 2,625 Mini-UAS sensors and 2,400 Nano-UAS sensors in 2021 — dwarfing tactical UAS sensor production rates and likely worth nearly $300 million.

For the speculative classified U.S. Air Force SEAD/Strike (suppression of enemy air defenses) UCAV, our forecast is for a mere 20 sensor suites produced annually from 2021 through 2026, costing about $20 million each (including installation, initial spares, etc.), worth about $400 million each year. While this will be the world’s number one UAS EO/ IR sensor program in value, compared to F-35 Joint Strike Fighter EO/IR it will be only a moderate program. With a more serious threat and a real need for stealthy unmanned ISR/SEAD or Strike, and if the Navy’s UCLASS program returns after

a downscoping and “destriking” to the new MQ-25 CBARS (Carrier Based Aerial Refueling System), UCAV could become the dominant place to be in UAS EO/IR.

EO/IR market shares

Regarding market shares and access, Raytheon has the vast majority of today’s contracted UAS EO/IR market in its back pocket. With long-term contracts for Reaper, Grey Eagle, and Triton (including contracted new high definition [HD] upgrade programs for the Air Force and Army), and legacy systems on Predator and Global Hawk, Raytheon will continue to earn the most EO/IR funding by far, probably indefinitely.

On the other hand, most of tomorrow’s programs are still uncontracted and available — we forecast three times the total funding value over the next decade is still available, compared to Raytheon’s currently contracted or expected share ($10.2 billion versus $3.2 billion). Aside from Raytheon, neither of the other Big Three defense companies (Northrop Grumman and Lockheed Martin) are significantly present in the UAS EO/IR market, despite past attempts by Northrop with Night Hunter and Raven Eye sensors, and recent attempts by Lockheed with its new INFIRNO gimbaled sensor.

A surprise second place will instead go to UTC Aerospace Systems (UTAS; a United Technologies company), which includes the legacy/Cold War era ISR firm Goodrich. Goodrich, or its own pre-acquisition companies, produced most of the high altitude manned U-2 ISR aircraft EO/IR sensors, and now that upgraded versions of these sensors are solidly funded for Global Hawk — to replace Raytheon systems — UTAS/Goodrich looks likely to become the world’s leading high-end, high altitude EO/ IR producer and developer. If they can also convert their dominance of the admittedly small manned tactical reconnaissance (tac recce) market — fighter-carried EO/IR pods — to a presence in the MALE or even large tactical UAS market, they could give Raytheon a run for the money for UAS EO/IR market control in a few years. Admittedly, though, that’s quite a longshot for what is still a fairly small defense firm. Also possible would be acquisition by Northrop Grumman or Lockheed Martin.

Among the smaller players, FLIR Systems, Inc. had looked likely to enter the market in force on Fire Scout and possibly the Predator XP, following great success with its tiny Omega/Micron/Photon sensors on mini-UAS such as Dragon Eye and Raven, but this now looks less likely. L-3 Wescam is also well positioned to move from manned aircraft gimbaled EO/IR to UASs, but they too have so far largely been stymied by Raytheon’s dominant gimbaled sensor position. Though we currently forecast them at just seventh and eighth overall, both these companies probably have the greatest possibility of a big market breakout in the next decade, as they both develop and produce a wide range of EO/IR sensors and technologies, at all scales. Either company could

challenge Raytheon across several market areas, but so far the U.S. military has preferred its long-term Big Three supplier. It has not been a lack of ability that has kept FLIR Systems and L-3 Wescam down, but of opportunity.

Scoring a surprising fourth and fifth in our forecast as sensor system prime contractors, AeroVironment and Alticam have grabbed future production for integration of the breakthrough new mini-gimbaled Mantis i23 payload for the Army’s Raven, and the very sophisticated new sensor ball for the US Navy/USMC RQ-21A Blackjack/Integrator Small TUAS (STUAS) program. Though not traditional defense sensor development companies, these two could ride the coming mini/nano-UAS boom.

Two other companies that make it into the top eight are BAE Systems (third) with a decades-long history of hyperspectral research, and Sierra Nevada (sixth) with their Gorgon Stare wide field-of-view program of record sensor system for the USAF Reaper.

With $906 million of EO/IR funding in FY ‘20 and $1.45 billion in FY ‘26 still unannounced or uncontracted, or classified, our “available” forecast indicates the UAS EO/IR market will continue to offer great opportunities in the future.

Dr. David L. Rockwell is Senior Electronics Analyst for Teal Group Corp., a provider of aerospace and defense competitive intelligence based in Fairfax, VA (drockwell@tealgroup.com).

Below: An AeroVironment Raven equipped with the Mantis i23 sensor payload. Photo: AeroVironment