In March, the White House released a fiscal 2020 defense budget request totaling $718.3 billion, which it said would invest in space and cyber warfighting domains, modernize air, maritime and land domains, innovate more rapidly to strengthen the nation's competitive advantage, and sustain the forces and readiness.

As part of the request, the services release budget estimates that detail unclassified procurement and research, development, test & evaluation (RDT&E) efforts.

AUVSI has reviewed the thousands of pages of budget documents to identify each program element (PE) associated with unmanned systems. The U.S. government is at the forefront of technology development in this sector. The data captured provides valuable insight into current focus areas and cutting-edge innovations for unmanned systems and robotics operating in the air, ground, surface, and subsurface domains.

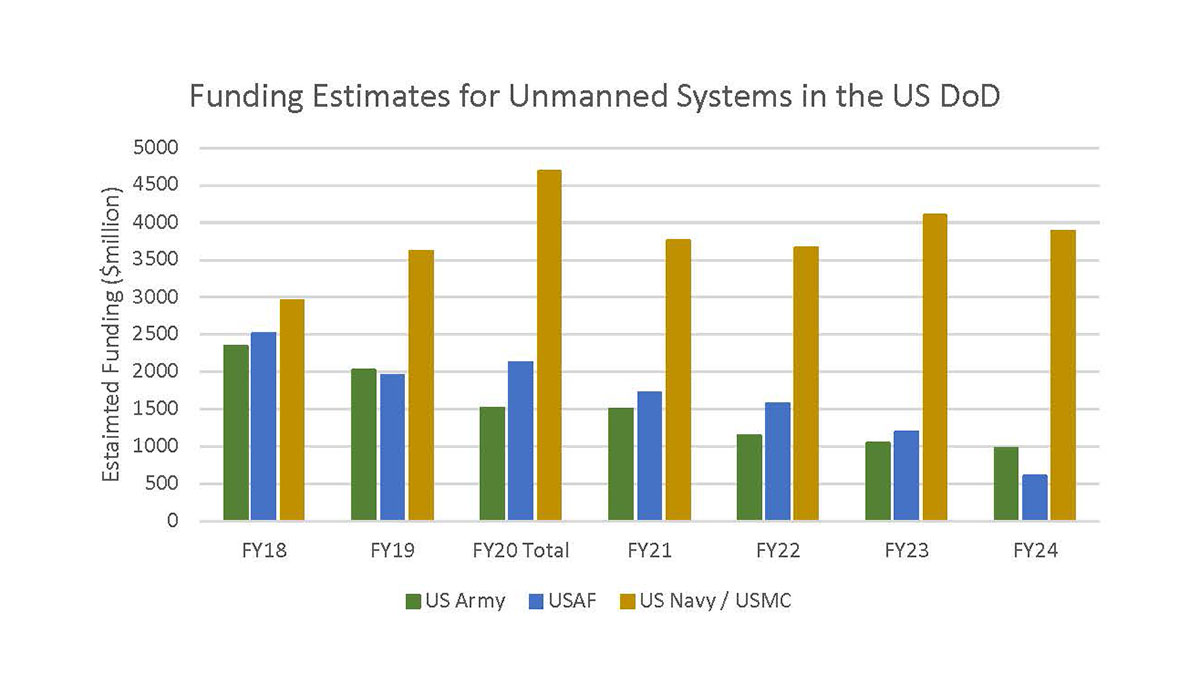

Figure 1: Total unmanned systems funding estimate

Figure 1 breaks down unmanned systems funding for the main services: Army, Air Force, Navy and Marine Corps. In fiscal year 2020 (FY20) the Navy/Marine Corps funding request exceeds the combined Army/Air Force funding request by more than $1 billion. This is in large part attributed to the Navy having the top three PEs in terms of total funding, including RDT&E for the MQ-25 Stingray UAS, the Large Unmanned Surface Vehicle (LUSV) and procurement of the MQ-4C Triton UAS.

Air Force PEs with significant funding include procurement of the MQ-9 Reaper UAS and associated Hellfire missile systems. The Army will also procure Hellfire missiles for their MQ-1C Gray Eagle UAS while continuing RDT&E support for the Robotic Combat Vehicle.

It is important to note that funding for FY21 through FY24 should not be assessed as a decline in support for unmanned systems. Generally, funding is only provided for PEs that have ongoing efforts from previous fiscal years or that initiate efforts in the current fiscal year. Therefore, if a program were to start in FY21, it would not appear in the total funding from figure 1.

The main takeaway is that despite the potential initiation of new procurement and RDT&E, which could further increase funding, ongoing Navy programs will continue to receive consistent support across the forecast period. On the other hand, Air Force and Army Programs of Record (POR) will likely be replaced by new POR in the coming years.

New starts

Services identify efforts as a new start when funding appears for the first time in a given fiscal year. The FY20 budget estimates include 26 unique new starts, with the Army accounting for 11 of these projects followed by the Navy with eight, Air Force with four and Marine Corps with three.

Looking at the technology areas covered by these new starts, we see that platform developments are the most common (35 percent) followed by sensors/payloads (23 percent), weapons (23 percent), propulsion/energy systems (15 percent), autonomy/control (12 percent), communications/data management (8 percent), manned-unmanned teaming (MUM-T) (8 percent), simulation (8 percent), and mobility (4 percent).

The new start with the largest funding in FY20 is LUSV with $372 million requested, followed by MQ-9A Reaper with $77 million in Overseas Contingency Operations funding to support Operation Freedom Sentinel, or operations in Afghanistan. Tactical Unmanned Aircraft System (TUAS) is the Army new start PE with the largest funding ($12.1 million) to procure 12 attrition aircraft for demonstration in support of Future TUAS.

Figure 2: Technologies being focused in FY20 budget estimates

Figure 2 breaks down the technologies being procured or developed in FY20. Sensors and payloads are the key enablers to provide mission capabilities for a given platform and thus are the most prevalent focus area.

Sensor upgrades in FY20 include a range of electro-optical/infra-red devices, signals intelligence (SIGINT) systems, offensive/defense electronic warfare capabilities, synthetic aperture radar, etc. Significant support is requested for the AQS-20C towed mine-hunting sonar, which is deployed from a USV for mine countermeasures operations; the Lynx SAR deployed from the MQ-9 Reaper UAS which provides high-resolution imagery through obscurants like clouds and smoke; and the MS-177 multispectral sensor which will be integrated into the RQ-4 Global Hawk Block 30 UAS to detect, track and assess targets.

Autonomy is another significant focus area, with 10 percent of projects supporting this capability. Technological improvements in this sector will allow for advanced missions like control of multiple USVs simultaneously; cross-domain swarming; advanced control automation techniques for MUM-T; autonomous convoy operations; air and ground resupply; advanced maneuvering in complex environments; autonomous obstacle avoidance; navigation in GPS-denied environments; laser detection and ranging, and others.

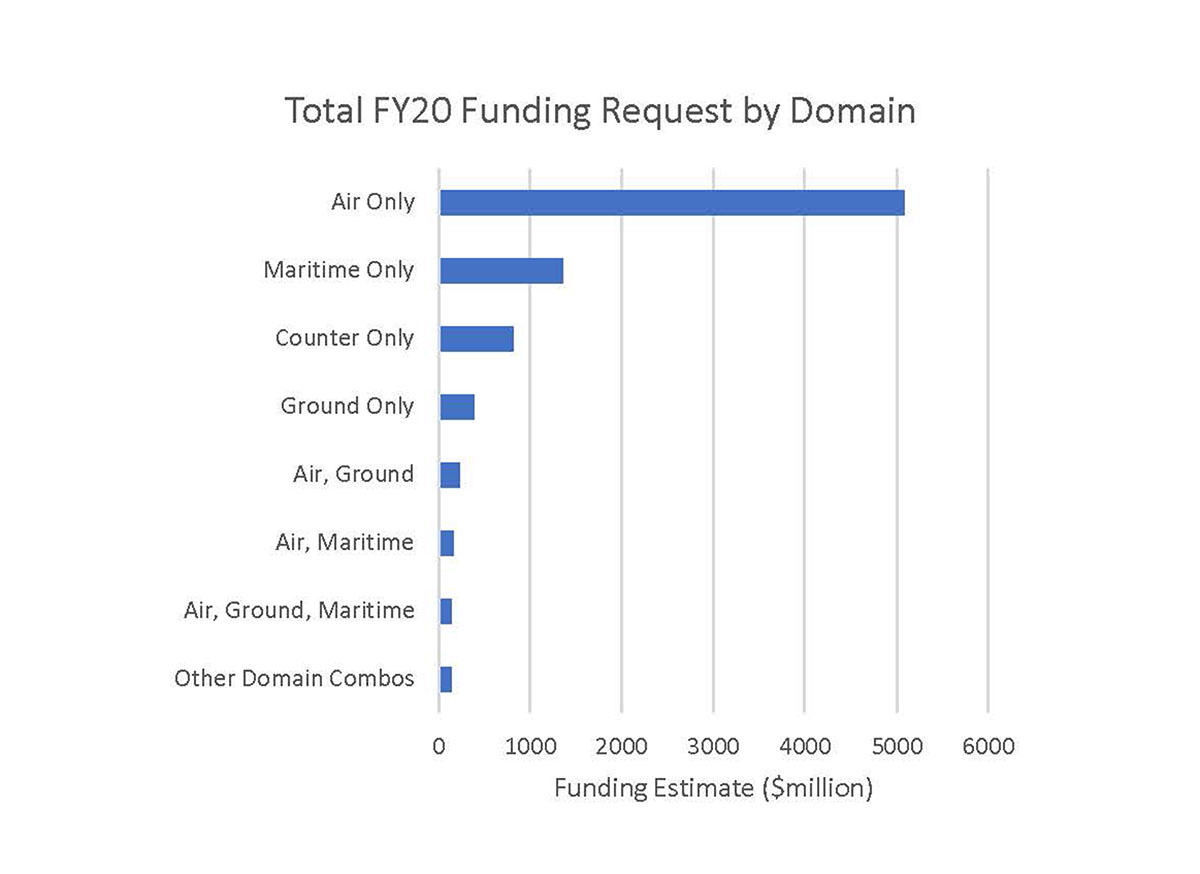

Figure 3: Breakdown of unique projects based on the domains in which unmanned systems are operating

Air domain focus

To give some quick background on the structure of the budget estimate documents, each overall effort is identified as a PE which is then broken down into projects.

For the current fiscal year, each project provides funding estimates from FY18 through FY24 as well as all prior year funding and cost to complete the project (if completion is within the scope of the projected forecast period).

Each project is then further broken down into sub-projects which often describe detailed plans for FY19/FY20 efforts as well as funding levels for FY18 through FY20. A total of 312 unique PEs were identified in FY20 with some level of support for unmanned systems and robotics. This accounts for a total of 521 sub-projects and the distribution by domain is provided in figure 3.

More than half of all efforts involve unmanned aircraft, which is consistent with research in previous years. This trend of technology focus for the air domain is further confirmed when considering the overall funding. Figure 4 separates funding based on the domains supported by RDT&E and procurement efforts.

Projects only involving the air domain account for over $5 billion in FY20, or 61 percent of the overall funding request for unmanned systems. Maritime-only PEs total $1.36 billion, or 16 percent of the overall funding request for unmanned systems, which is consistent with the value captured in figure 3.

PEs solely funding systems to counter unmanned systems threats amount to about $812 million (less than 10 percent of overall funding) and PEs for solely ground systems sum to $386 million (less than 5 percent of overall funding). Not surprisingly, the air domain is most prevalent for PEs funding multiple domains with the air-ground combination having the largest support ($233 million) followed by air-maritime ($171 million) and air-ground-maritime ($147 million).

Figure 4: FY20 funding estimate separated by the domain supported for each effort.

In FY20, the funding estimates for procurement and RDT&E in the core services of the Department of Defense are approximately the same, with $4.2 billion in procurement and $4.1 billion in RDT&E.

Figure 5: Funding distribution for procurement and RDT&E for the core services of the US DoD in FY20.

Figure 5 shows that funding for unmanned systems in the Navy is steadily increasing in both procurement and RDT&E. Army procurement is on a decline as they seek to find replacements for the aging MQ-1C Gray Eagle UAS fleet as well the RQ-7B Shadow. Air Force procurement shows a decline from FY18 to FY19, but rebounds with the acquisition of three low-rate initial production MQ-4C Triton UAS and associated equipment/subsystems in FY20. RDT&E efforts for the Army and Air Force remain somewhat constant across the forecast period, with slight decreases from FY19 to FY20.

It should be noted that the totals provided in this article are only estimates and must go through a lengthy legislative process involving considerations by both the House and Senate Armed Services committees as well as the Appropriations committees.

The finalized authorizing legislation, known as the National Defense Authorization Act (NDAA), and the appropriations legislation, will take into account recommendations from the congressional committees and make changes to funding accordingly. The President must then sign the bill for the funding to be appropriated to the services.

AUVSI will continue to track this legislation as it progresses, and a finalized report will be issued that incorporates any changes from the funding levels described above. This report will be completed later in 2019 following the signing of the federal funding measures.

Above: An MQ MQ-1C Gray Eagle, shown here alongside an Apache helicopter. New program starts in the manned-unmanned teaming arena make up 8 percent of the fiscal 2020 budget request. Photo: General Atomics Aeronautical Systems Below: The AQS-20C mine-hunting sonar, shown here being lowered into the Gulf of Mexico, is supported in the FY2020 budget request. Photo: U.S. Navy/Eddie Green