From Unmanned Systems magazine: Market Report Part 2: Legacy geographies point to new growth in radio frequency UAS sensors

Airborne synthetic aperture radars, or SARs, process radar returns as if they were collected by an antenna as much as several hundred meters long.

This “synthetic” antenna aperture is created by the movement of the aircraft itself — which is why airships do not make good SAR platforms — and allows a “parallax view” of the ground similar to a stereoscopic optical image. SARs were developed during the Cold War for their radio frequency ability to provide ground reconnaissance through the clouds and bad weather in Europe, unlike visual, infrared, and even hyperspectral sensors, and for ground moving target indication, which measures the displacement of vehicles and other objects during the radar scan.

Conflicts of the last decade and a half saw a major shift in geography and opponents, with clear skies much more the norm throughout the Middle East and Central Asia. This led to explosive growth in electro-optical sensors (and the defenseless unmanned aircraft and aerostats carrying them). But today, with increased Russian activity in Europe and the “pivot to Asia” leading strategic thinking back to more varied climates and weather, the need for SARs will become more important than ever.

Glowing SAR market

UAS SAR funding has already more than tripled over the past decade. Initially, most of this was due to major RDT&E funding for Northrop Grumman/Raytheon’s large AN/ZPY-2 MP-RTIP (Multi-Platform Radar Technology Insertion Program) radar for the Block 40 Global Hawk, but in the past few years several smaller SAR production programs, including Starlite and Lynx radars for Predator A and B variants, the Gray Eagle and Reaper, have funded a broader and more robust increase.

We had earlier forecast a continuing dominance of MP-RTIP, much as JSTARS dominated the manned SAR market for decades, but it now looks like not only has USAF MP-RTIP production ended prematurely at 11 radars, but the Air Force even considered “divesting” the entire Block 40 Global Hawk fleet. Apart from the USAF, the final two of five MP-RTIPs were completed in 2016, for NATO Alliance Ground Surveillance Global Hawks, and MP-RTIP/AGS funding has now suddenly dropped from more than $300 million annually to only about $100 million. MP-RTIP will likely remain a major program for a decade or more, but will no longer dominate.

The few other legacy UAS SARs, all smaller systems like Raytheon’s Block 30 Global Hawk HISAR and perhaps General Atomics’ Lynx, will also soon shrink in importance once production ends. However, Teal Group sees the future for the UAS SAR market as nothing other than glowing, for the geopolitical and technical reasons described above, and today’s watershed — and a brief funding lull in fiscal year 2017 after MP-RTIP production ends — will presage massive growth in the market for next-generation systems.

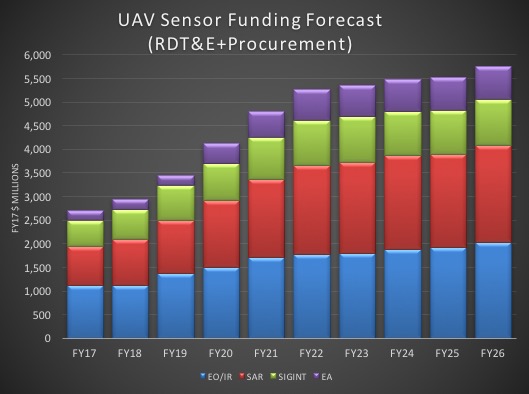

We forecast total market funding available to U.S. manufacturers will more than double from $829 million in FY ‘17 to $2.1 billion in FY ‘26, with a 10.7 percent compound annual growth rate (CAGR), led by classified stealthy systems such as the radar for the Air Force’s recently revealed (and now black again) high-altitude RQ-180 ISR UAS, and several systems for classified and unclassified semi-stealthy UCAVs for the U.S. Air Force and Navy.

Other new markets will grow with unclassified radars such as the Northrop Grumman AN/ZPY-3 Multi-Function Active Sensor (MFAS) radar for the Navy’s maritime BAMS MQ-4C Triton (based on Global Hawk), which finally has solid large-scale production beginning now, as well as other new near-future maritime and endurance UAVs. Finally, smaller SARs for tactical UAS have been sought for many years, and we see major production of new systems beginning in the next decade for the U.S. Navy’s Fire Scout, the U.S. Army’s RQ-7 Shadow, and other small UAS.

The drone SAR market may be the place to be in ISR sensors for the next decade, but an increasing percentage of the market will be classified systems funded by classified budgets. Thus, Teal Group’s forecast has more than its share of speculation. We have confidence in our overall market forecast, as supported by recent news and documents and contracts, but funding may shift somewhat between new and classified programs as the UAS SAR market grows steadily through the next decade.

Great opportunities

In terms of market access, the UAS SAR market earlier seemed to be offering great opportunities to new firms, with several small developers earning big contracts.

Instead, Northrop Grumman has led the drone SAR market for the past decade in a dominant fashion, with the majority of MP-RTIP funding as well as MFAS and the much smaller Starlite. But Raytheon (MP-RTIP and HISAR) and General Atomics (Lynx) have substantial shares, and Telephonics was recently chosen by the Navy to provide the AN/ZPY-4 maritime radar for Fire Scout. In fact, with MP-RTIP/AGS production now ended, General Atomics — not even primarily an electronics or radar producer — will lead the unclassified UAS SAR market for the next few years until the US Air Force’s major procurement for Reaper Lynx new production and upgrades ends. A reasonably healthy market mix should continue for at least a few years, and Teal Group also suspects other firms besides Northrop Grumman may hold a large share of some classified programs — perhaps even Lockheed Martin, which does not figure in the unclassified market at all.

More importantly, the coming growth we forecast in planned and speculative programs is largely still uncontracted. Beginning in FY ‘18, 46 percent or more of our forecast funding is still available. And fully 74 percent or more annually of UAS SAR funding forecast from FY ‘22 onward is still uncontracted and often still unbudgeted.

Northrop Grumman will likely earn a substantial portion of this, and will likely return to the No. 1 market position in the second half of our forecast, with continuing Triton MFAS and other programs, but small technology companies could suddenly find themselves at least a moderate player (perhaps before being bought out or passed over), especially for new tactical or micro/nano-UAV radars. Major radar firms such as Lockheed Martin and Raytheon would also be wise to pursue the UAV SAR market — it is likely they already have, in classified markets, and will offer major subcontracting opportunities.

SIGINT becomes A-list

Signals Intelligence (SIGINT) sensors now garner genuine “A-list” funding for drones as well as manned airborne platforms. Because threats are constantly evolving, and because detecting improvised explosive devices has become so dependent on SIGINT, continuing RDT&E and upgrade funding will be needed, even for legacy systems. SIGINT is a general term that includes radio band (COMINT — communications intelligence), radar band (ELINT — electronic intelligence), and MASINT (measurement and signature intelligence) systems.

SIGINT has had a relatively low profile among manned electronic warfare programs in the past, while jammers and radar and missile warning systems have gotten most of the attention and funding. But that has changed since the conflicts began in Afghanistan and Iraq, and the threat continues today from non-state actors worldwide; again, new geographies have resulted in changing needs. Monitoring civilian communications has become more vital than fighting sophisticated surface-to-air missile radar networks, as IEDs have resulted in a large proportion of U.S. casualties.

By 2017, the biggest SIGINT programs of record for UAS were already well established, with production under way in some (not yet all) cases, but with at least Quick Reaction Capability systems already aboard most drones. But if production of U.S. Navy and Air Force UCAVs — including likely classified programs with new electronic attack (EA) systems — goes ahead, mid-term funding growth will accelerate at the end of the decade, leading to a spectacular 18.8 percent CAGR, from $961 million in FY ‘19 to $1.6 billion in FY ‘22. Overall growth in our forecast period will see a 9.2 percent CAGR, from $752 million in FY ‘17 to nearly $1.7 billion in FY ‘26.

ASIP and others

Many inexpensive, short-range COMINT receivers on UAS, in direct support of ground troops, have already been procured for all scales of UAS, usually as minor acquisitions, not programs of record. Larger-scale, longer range, more sophisticated and expensive COMINT systems for endurance UAS have also been in development for more than a decade, with Northrop Grumman’s Airborne Signals Intelligence Payload (ASIP) entering production several years ago. On U.S. Air Force Global Hawks, Reapers and Predators (QRC systems), and also manned U-2 and (Army) Guardrail aircraft, ASIP became the first major manned-aircraft-equivalent UAS SIGINT program, earlier funded at $200 million per year or more (UAS component). But reduced future funding will be mostly for upgrades.

In May 2017, ASIP Increment II was funded as a new start program in the USAF budget, to expand COMINT and ELINT frequency range, reduce special signals bandwidth, and decrease mission loading time via a new encryptor system. Build A upgrade kits for 21 Block 30M Global Hawks (and seven spares) are scheduled to begin in FY ‘18, with Build B projected for an FY ‘22 start date.

In May 2017, the USAF also planned new and upgraded SIGINT sensors to be integrated and tested on various platforms including Predators and Reapers, including new signal sets, antenna improvements, sensitivity upgrades, data distribution upgrades, and new and advanced deployment capabilities. But the funding and details of these programs have gone classified since public MQ-1/MQ-9 funding disappeared in FY ‘16.

The U.S. Army’s signature program has been BAE Systems’ Tactical SIGINT Payload (TSP), funded since 2001, originally planned for smaller tactical UAS such as Shadow and Fire Scout, but more recently for the Predator-derived Gray Eagle. Progress has been slow, especially for the smaller UAS, and the Army has been keeping its production options open. There will eventually be high-volume production of a SIGINT system for medium altitude long endurance UAS, but it may or may not be from BAE Systems. We include large speculative, undetermined future forecast lines.

The Navy will be watching you

In July 2011, the U.S. Navy claimed it would retire its manned airborne EP-3E Aries II SIGINT fleet in 2019-2020 and replace them with an all-unmanned fleet. However, no drone in the air today (or planned) comes anywhere near the 20,000-pound payload capacity of the four-engine EP-3E, and for years the Navy had no major public UAS SIGINT program other than Sierra Nevada Corp.’s AN/ZLQ-1 Merlin-MC electronic support measures suite, planned to be a small component of the MQ-4C Triton UAS’ multi-INT sensor suite, alongside the MFAS radar and EO/IR.

Instead, Teal Group has become increasingly convinced of major classified UAS SIGINT developments by the Navy, including what we now dub the Future Triton SIGINT Suite, likely to be bought for a limited number of Tritons.

Germany gave indications in 2016 of purchasing three MQ-4C Tritons to carry Airbus Defence & Space’s already-developed ISIS (Integrated SIGINT System) sensor from the canceled Global Hawk “Euro Hawk” SIGINT program, with the procurement finally approved in March 2017. We now believe the U.S. Navy (or possibly the Air Force) is likely developing a similar all-SIGINT high-altitude-long-endurance UAS, and Triton would be the obvious platform to use, as it is approaching certification for use in civilian airspace. Yes, this means it will also monitor civilians — probably why the Department of Defense wants to keep it classified.

Mini/Nano and UCAV EA

Much as Teal Group forecasts for the UAV EO/IR sensor market (see the first article in this series), classified combat UCAV and mini/nano-UAV markets will provide the biggest growth markets in the out-years of our forecast. But the SIGINT component of this growth will remain relatively steady, even when including speculative classified funding forecasts.

Instead, the electronic attack market for suppression of enemy air defenses and strike UCAVS will see major funding and grow from a small market today to the dominant market next decade. This will be something of a shift back to traditional EW funding — manned-equivalent systems and funding for air strike missions versus near-peer opponents such as Russia or China. Most of these programs will undoubtedly remain classified, but our funding forecasts in line with legacy manned EA programs will lead the UAV EA market to grow from $70 million in FY ‘17 to $534 million in FY ‘26.

Much classified

With ASIP the dominant SIGINT system in service, Northrop Grumman will continue to lead the contracted UAV SIGINT market for several years. BAE Systems has so far won all U.S. Army TSP production, but funding has been minor with continuing delays, and future production is still uncertain. On the other hand, BAE is likely to earn a good share of our “available” SIGINT forecasts, with a massive $7.9 billion still available (or classified) from FY ‘17 to FY ‘26, and BAE should remain a viable competitor to Northrop Grumman.

Perhaps surprisingly, Raytheon leads our 10-year funding share forecast, due mostly to its contracted development of the Next Generation Jammer, a platform-agnostic EA system whose first production platform will likely be a SEAD/strike UCAV despite public plans for the manned EA-18G Growler.

Aside from Northrop Grumman and BAE Systems, there are today no obvious competitors for major U.S. UAS SIGINT programs. But this is probably because so many programs are classified and competitors are unknown, rather than a lack of competition. Despite our large speculative “other” forecast for already-contracted but unknown prime contractors, our “available” funding forecast will grow to an average of 62 percent of the UAV SIGINT & EA market annually from FY ‘22 through FY ‘26, worth about $1 billion each year.

Below: The StarLite Tactical Radar, part of Northrop Grumman's SAR market dominance. Photo: Northrop Grumman